Comprehensive Brigit Review 2025: Insights and Key Features Explained

In today’s fast-paced financial landscape, individuals often seek solutions that offer immediate support and improved cash flow management. The Brigit app has emerged as a noteworthy contender, providing innovative services designed to help users navigate their financial challenges effectively.

This Brigit review will explore the app’s functionality, benefits, and potential drawbacks, while also examining its position relative to other financial tools, thereby offering a comprehensive perspective for potential users.

Contents

Understanding Brigit

Brigit is a mobile application designed to assist users in managing their financial health, primarily by providing budgeting tools and cash advance services. It aims to help users navigate cash flow challenges and reduce the stress associated with financial uncertainties. By employing sophisticated algorithms, Brigit analyzes spending patterns to deliver personalized financial insights.

The app serves as a financial companion, enabling users to access short-term cash advances without traditional credit checks. Brigit also offers budget tracking, alerts for upcoming bills, and recommendations for savings, which contribute to a holistic approach to personal finance management. This combination of features makes Brigit an appealing option for individuals seeking more control over their financial situations.

Understanding Brigit’s functionalities is essential for users aiming to enhance their financial literacy and decision-making. As an innovative tool, it requires users to engage actively with its features to reap the full benefits. Overall, Brigit addresses a critical need in the fast-paced modern economy, helping users achieve greater financial stability.

How Brigit Works

Brigit functions as a personal finance tool designed to assist users in managing their financial health. It provides users with real-time insights into their spending, saving, and credit. Upon registration, users are guided through an onboarding process that connects their bank accounts securely, enabling Brigit to analyze their financial patterns.

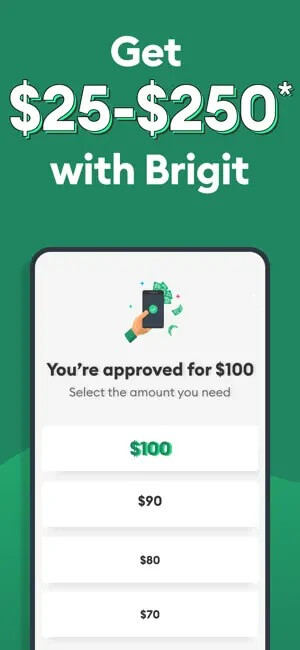

The services offered include instant cash advances, budgeting tools, and credit score tracking. Users can access funds up to $250 without interest, aimed at helping them avoid overdraft fees. Additionally, Brigit provides personalized tips for enhancing their budgeting strategy, contributing to overall financial wellness.

Brigit’s automated system continually assesses users’ financial situations, allowing the app to offer tailored advice and alerts. This feature empowers users to stay informed of their spending habits and potential financial pitfalls. Such functionalities make Brigit a valuable resource for those seeking to improve their financial management skills.

Onboarding Process

The onboarding process for Brigit is designed to be user-friendly and efficient, allowing new users to set up their accounts with minimal effort. After downloading the app, users initiate the onboarding by providing basic personal information, such as their name, email address, and phone number.

Following the initial data entry, users are prompted to link their bank accounts securely. This integration enables Brigit to analyze the user’s financial habits and needs, paving the way for personalized services. The app utilizes advanced encryption protocols to ensure that user data is protected throughout this process.

Once the bank account is linked, users receive tailored insights based on their financial behavior. This personalized approach helps identify potential borrowing needs and how Brigit can assist in managing finances effectively. Overall, the onboarding process is streamlined, ensuring a seamless experience for users right from the beginning of their journey with Brigit.

Services Offered

Brigit offers a diverse range of financial services designed to assist users in managing their monetary needs effectively. At its core, the app provides cash advance features, enabling users to access funds when they face unexpected expenses before their payday.

In addition to cash advances, Brigit includes budgeting tools that help users assess their financial health. These tools analyze spending patterns, providing insights and recommendations to enhance financial management and promote better habits.

Moreover, Brigit offers a subscription service that provides credit score monitoring and alerts. This feature enables users to stay informed about their credit status and receive notifications of significant changes, thereby facilitating proactive financial planning.

Finally, the app emphasizes financial education with resources that guide users on topics such as debt management and saving strategies. Together, these services create a comprehensive platform that addresses various financial challenges faced by users, making Brigit a valuable resource in personal finance management.

Benefits of Using Brigit

Brigit offers multiple advantages to users seeking to improve their financial management. One significant benefit is its ability to offer real-time insights into spending habits, fostering better budgeting practices. This feature helps individuals maintain control over their finances and avoid unnecessary expenditures.

Another key advantage is the early access to paycheck advances. This allows users to access funds before their payday, providing flexibility during financially strained periods. With a simple application process, users can quickly request and receive funds without the burden of traditional loans.

Furthermore, Brigit provides personalized financial recommendations based on user data. By analyzing patterns and spending behavior, the application suggests actionable strategies to enhance savings and manage debts effectively. This tailored approach enables users to make informed financial decisions and set achievable financial goals.

Lastly, the app’s intuitive interface ensures a seamless user experience, promoting financial literacy. Through educational resources and tools, Brigit empowers users to make wiser financial choices. These benefits collectively make Brigit an appealing solution for those striving for improved financial health.

Possible Drawbacks of Brigit

While Brigit offers various benefits to its users, there are notable drawbacks to consider. One primary concern is the monthly subscription fee, which may deter individuals on tight budgets. This fee might outweigh the financial benefits for those utilizing Brigit sporadically.

Another drawback is the potential for dependency. Users may come to rely heavily on Brigit’s advances, leading to poor financial habits. This reliance can create a cycle of borrowing that complicates overall financial health and exacerbates existing fiscal challenges.

Brigit’s services are primarily aimed at those with steady income streams; therefore, individuals with fluctuating earnings or those who work irregular hours may find the service less accommodating. This limited applicability restricts the user base and may not be suitable for all demographics.

Customer support options are also a concern. Users have reported delays in response times for inquiries, which can be frustrating during urgent situations. Such issues may hinder the overall user experience, particularly for individuals seeking immediate assistance.

Target Audience for Brigit

Brigit primarily caters to individuals seeking financial support and management tools to enhance their budgeting skills. This service is particularly useful for those who may not have access to traditional banking resources or face challenges in managing their finances effectively.

The ideal users of Brigit include:

- Working professionals who experience cash flow fluctuations.

- Students balancing education expenses with limited income.

- Families needing assistance in managing day-to-day expenses.

- Individuals aiming to build savings without incurring high fees.

Brigit attracts users who value the convenience of financial technology. Those with a strong inclination towards mobile apps for managing their finances are likely to benefit the most from its services.

Who Should Use Brigit?

Brigit is particularly suitable for individuals facing challenges in managing their finances or those who often find themselves with irregular cash flow. Specifically, it appeals to:

- Young Professionals: Those early in their careers may experience fluctuating income levels and can benefit from Brigit’s budgeting assistance and cash advances.

- Gig Economy Workers: Freelancers and contractors often deal with inconsistent pay schedules, making a service like Brigit invaluable for addressing financial uncertainty.

- Budget-Conscious Individuals: Users who prioritize financial literacy and seek tools for better money management are likely to find Brigit’s features useful.

- Those Seeking Short-Term Solutions: Individuals looking for immediate financial relief without resorting to high-interest loans can leverage Brigit to access funds quickly.

In summary, Brigit is designed for users who require a flexible financial app that supports effective budgeting and provides quick cash access during lean periods. This makes it a compelling option for a diverse range of financial needs.

Ideal User Profiles

Brigit is particularly suited for a diverse range of users seeking financial management solutions. Those with irregular income, such as freelancers or gig workers, may find Brigit beneficial in managing cash flow and avoiding overdraft fees.

Additionally, individuals who regularly encounter unexpected expenses can leverage Brigit’s features to access funds quickly. This functionality allows users to cover essential bills and maintain their financial health without resorting to high-interest loans.

Young professionals and college students, often navigating tight budgets, can benefit from the budgeting tools provided by Brigit. These tools assist in tracking spending patterns and establishing savings goals, enabling a more secure financial future.

Families seeking to balance their monthly budgets may also find Brigit advantageous. By utilizing the app’s cash flow insights, they can make informed decisions about their finances and effectively plan for future expenses.

Comparisons with Other Financial Apps

Brigit stands out in the crowded field of financial apps by offering unique features that set it apart. Unlike traditional budgeting applications like Mint, which focus primarily on expense tracking, Brigit emphasizes real-time financial management, providing users with instant access to funds through advances when needed.

When compared to other lending solutions, such as Dave or Earnin, Brigit operates on a subscription model rather than a tip-based or interest structure. This approach promotes transparency in user costs and eliminates uncertainty often associated with variable fees, making Brigit more appealing for users who prefer clarity in financial transactions.

Furthermore, unlike many financial tools that merely aggregate financial data, Brigit incorporates personalized insights to help users understand their spending habits. This tailored approach not only improves user engagement but also fosters healthier financial habits, positioning Brigit as a more holistic financial companion.

User Experience and Feedback

User experiences with Brigit often highlight its user-friendly interface and straightforward navigation. Many users appreciate the seamless onboarding process, which enables them to quickly access essential functionalities without encountering technical difficulties. This ease of use significantly contributes to the overall satisfaction reported by consumers.

Feedback indicates that the app’s features, such as financial insights and cash advance options, are practical and serve their intended purpose well. Users have noted the effectiveness of Brigit in helping them manage their finances, particularly during unforeseen circumstances. Positive reviews frequently emphasize the app’s transparency regarding fees and services.

Despite the favorable reviews, some users have expressed concerns about customer support responsiveness. A few feedback submissions indicate delays in receiving assistance when issues arise. This aspect could be crucial for users who prioritize reliable support in financial applications.

Overall, Brigit’s user experience is generally positive, marked by functionality and user-centric design. However, areas such as customer service may require attention for improvement, particularly in enhancing user confidence and satisfaction.

Security and Privacy Measures

Brigit prioritizes user security and privacy through multiple robust measures designed to protect sensitive information. The application utilizes bank-level encryption to safeguard financial data during transmission and storage, ensuring that personal information remains confidential.

User authentication is another cornerstone of Brigit’s security practices. The app employs multi-factor authentication (MFA) to add an extra layer of protection, requiring users to verify their identity through different methods before accessing their accounts. This significantly reduces the risk of unauthorized access.

Brigit is also transparent about its data usage policies. The app adheres to strict protocols, ensuring that personal data is not sold to third parties. Users retain control over their information, with options to limit data sharing according to their preferences.

Key security features include:

- Bank-level encryption for data protection.

- Multi-factor authentication for user verification.

- Clear data usage policies to maintain user privacy.

Future of Brigit

As Brigit looks ahead, it aims to enhance its service offerings, focusing on features that promote financial wellness. Upcoming updates may include advanced budgeting tools and personalized financial coaching, helping users manage their finances more effectively.

The company is also exploring partnerships with other financial institutions to broaden its service range. These collaborations could introduce additional features like savings programs or investment opportunities, positioning Brigit as a more comprehensive financial solution.

Market positioning will play a vital role in Brigit’s strategy. By adapting to evolving user needs, the platform seeks to maintain its competitive edge amidst a growing landscape of financial apps. Staying relevant will be paramount for attracting new users while retaining existing ones.

User feedback will inform the development of these future features, ensuring they align with customer expectations. By prioritizing user experience and continuously improving, Brigit is poised to become an invaluable resource for those seeking financial assistance.

Upcoming Features and Updates

Brigit is poised to introduce several exciting features and updates aimed at enhancing user experience and functionality. One notable update includes the integration of personalized financial coaching, which will allow users to receive tailored advice based on their spending habits and financial goals.

Additionally, Brigit plans to expand its budgeting tools, providing users with more advanced analytics and insights into their financial behaviors. This feature aims to assist users in managing their budgets more effectively and making informed financial decisions.

Another anticipated improvement is the expansion of the app’s predictive analytics capabilities, which will offer insights into potential future financial scenarios. These updates position Brigit to not only serve as a short-term financial aid but also as a comprehensive long-term financial planning tool.

With these upcoming features, Brigit intends to solidify its market position as a leading financial app for those seeking innovative, user-friendly solutions for personal finance management.

Market Positioning

Brigit occupies a unique niche within the financial technology landscape by focusing on helping users manage their cash flow effectively. Positioned as a highly accessible tool for individuals seeking to avoid overdraft fees, Brigit combines financial literacy with practical budgeting solutions. It aims to support those with irregular income streams, offering timely insights into their financial status.

The application sets itself apart by emphasizing its forecasting capabilities, allowing users to anticipate their financial needs. By providing personalized alerts regarding low balance warnings or upcoming bills, Brigit helps users make informed spending choices. This proactive approach to financial management positions Brigit as an attractive option for those striving for greater financial stability.

Furthermore, Brigit’s user-friendly interface and onboarding process cater to a younger demographic that is often more comfortable navigating digital platforms. As an emerging player in the financial app market, Brigit aims to distinguish itself from traditional banking solutions as well as other fintech applications by promoting user empowerment through financial awareness and planning.

Final Thoughts on Brigit

Brigit stands out as a notable financial tool designed to offer flexibility and support for individuals facing cash flow challenges. Its emphasis on user-friendly services makes it particularly valuable for those in need of short-term financial relief. Reviewing Brigit reveals its potential to streamline budgeting and improve financial confidence.

Users can appreciate the app’s innovative features, such as the automated budgeting tools and access to small advances, which cater to immediate needs. This functionality positions Brigit as a favorable alternative for consumers seeking straightforward financial solutions without complicated procedures or hidden fees.

While Brigit presents numerous advantages, potential drawbacks, such as fees associated with premium features, warrant consideration. Nonetheless, for those who align with its target audience, the benefits may far outweigh the costs. Overall, Brigit is a compelling option in the evolving landscape of financial apps.

The future looks promising for Brigit, with anticipated updates aimed at enhancing user experience and expanding its market reach. As users navigate their financial journeys, tools like Brigit can play a pivotal role in shaping responsible money management habits.

Summary

In summary, this Brigit review has highlighted the app’s unique features and the advantages it offers users. Its financial assistance capabilities and user-friendly design make it a compelling option for those seeking to manage their finances more effectively.

However, it is essential to weigh the potential drawbacks and ensure that Brigit aligns with personal financial goals and lifestyles. As the app continues to evolve, it remains a noteworthy tool in the ever-growing landscape of financial applications.